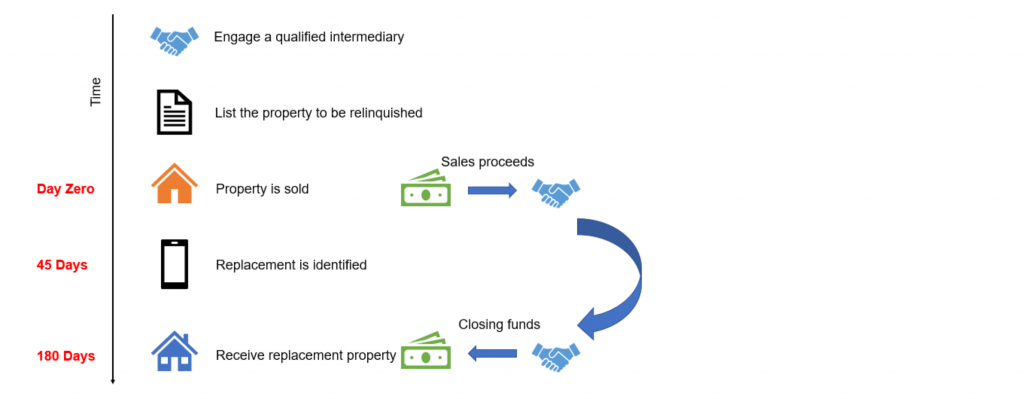

What a difference! It’s no wonder savvy real estate investors are tapping into this strategy more and more. This table also doesn’t account for current cash flow generated during each hold period, which would presumably be higher when using 1031 exchanges to increase purchasing power for each reinvestment.Īfter 20 years, the expected portfolio value of $1,920,000 when pursuing a 1031 exchange strategy compares favorably with a projected value of only $1,519,590 when paying capital gains taxes along the way. Simplify your rental property reporting with Stessa > The first purchase below was made with 20% down, which is then reinvested into the second property, and so on. We are using round numbers, excluding a lot of variables, and assuming 20% total appreciation over each 5-year hold period for simplicity. Read on for the guidelines and timeline, and access more information about updates after the 2020 tax year here.Ĭonsider a tale of two investors, one who used a 1031 exchange to reinvest profits as a 20% down payment for the next property, and another who used capital gains to do the same thing: 1031 Exchanges have a very strict timeline that needs to be followed, and generally require the assistance of a qualified intermediary (QI). This maneuver helps investors stay more liquid and redeploy capital gains to scale their real estate portfolios at a more meaningful pace.īut if the IRS’ 1031 Exchange rules aren’t followed to the letter, real estate investors will be liable for capital gains taxes.

Territories such as Puerto Rico and the Virgin Islands.įor active real estate investors, performing 1031 exchanges on properties they’re selling and buying allows them to defer paying capital gains tax and/or completely eliminate them through estate planning. Opportunity zones are in all 50 states, and U.S. However, the Act created an Opportunity Zones incentive to encourage long-term and tax-deferred investments in urban and rural areas with low-incomes. That includes items such as machinery, equipment, artwork, collectibles, patents and intellectual property. The Tax Cuts and Jobs Act of 2017 eliminated personal and intangible property from being included in tax-deferred exchanges. The IRS considers real estate property to be like-kind regardless of how the real estate is improved.įor example, real estate investors can exchange a small apartment building for a larger apartment project, for an office building, or for vacant land. #2: Identify Eligible Properties for a 1031 ExchangeĪccording to the Internal Revenue Service, property is like-kind if it’s the same nature or character as the one being replaced, even if the quality is different. Real estate investors making like-kind exchanges generally aren’t required to recognize a gain or loss under the Internal Revenue Code, unless they receive other not like-kind property or money, or if the property was held mainly for sale and not for business use.

Irc 1031 code#

Under Section 1031 of the Internal Revenue Code like-kind exchanges are “when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or ‘like-kind’.” This strategy has been permitted under the Internal Revenue Code since 1921, when Congress passed a statute to avoid taxation of ongoing investments in property and also to encourage active reinvestment. #1: Understand How the IRS Defines a 1031 Exchange

For more information on 1031s for commercial assets, check out this post. So what is a 1031 Exchange, how does it work, what are the different types and how do you avoid common mistakes? Complete the six steps below and you’ll learn everything you need to know about 1031 Exchanges. Savvy real estate investors know that a 1031 Exchange is a common tax strategy that helps them to grow their portfolios and increase net worth faster and more efficiently than would otherwise be possible.

0 kommentar(er)

0 kommentar(er)